Saudi’s #1 Arabic E-Signature Solution

Empowering Saudi businesses with effortless digital signatures—secure, compliant, and designed for seamless use in both Arabic and English.

Start Free TrialDigital contract creation in Saudi Arabia is evolving, with only a handful of platforms fully compliant with Saudi government rules and regulations. These platforms are approved by the Saudi Court of Law and authorized by SAMA, the Saudi Central Bank.

In this article, we’ll explore how to create secure banking contracts using one of these platforms. We’ll also highlight why adopting such a solution is essential for businesses in 2025 as they navigate the country’s digital transformation and regulatory landscape.

Saudi Arabia is Embracing Digital Transformation

Paper trails are disorganized, challenging to follow, and only as safe as the storage cabinets in which they are kept. This also applies to the paper trails that financial services and banking leave behind.

All of the paperwork involved in creating accounts, taking out loans, monitoring investments, and repaying them might be daunting.

Discover how to convert your printed trails to digital ones for increased convenience, security, organization, and peace of mind.

Electronic signatures are one method banks may use to reach and gain the trust of the digital generation.

With the use of this tool, customers can get the financial services and products they require while on the go, eliminating the need for paperwork and the requirement to sign documents in person at a branch.

Learn More About The Role of Digital Signatures in Government Digital Transformation

Benefits of e-Signature Solutions for banking contracts in Saudi Arabia

The banking industry’s use of electronic signatures has revolutionized and enhanced how financial institutions function and engage with their clientele. A successful business depends on providing solutions to assist its clients and on having loyal customers.

In addition to providing security, transparency, and a client experience that was unimaginable only a few years ago, eSignatures assists financial institutions in expanding their online operations. Here are some of the advantages for bankers and clients of employing electronic signatures:

Security:

Compared to traditional signatures, electronic signatures enhance document security as they use encryption to verify the authenticity of signed documents.

Compared to “wet” signatures, eSignatures are also more secure.eSignature technology creates digital trails, which allow you to see who, when, and where someone signed a document.

Furthermore, a lot of eSignature technologies provide identity verification techniques and digital encryption, which minimizes the possibility of signature forgery.

Learn More about how Signit Received ISO 27001 Certification for Information Security Management

Quicker transactions:

Both the banker and the customer gain when electronic signatures facilitate the processing of paperwork and transactions, such as when creating new accounts or approving loans. Instead of taking days, financial accounts can be created in a matter of minutes.

If banks use eSignatures, they will no longer have to print and mail documents for customers to sign, which will cut down on the amount of time it takes to offer their goods and financial services.

They enable customers to do so without having to sign any paper forms, from the convenience of their laptop or smartphone and any location.

Saudi’s #1 Arabic E-Signature Solution

Empowering Saudi businesses with effortless digital signatures—secure, compliant, and designed for seamless use in both Arabic and English.

Start Free TrialCustomer convenience:

Electronic signature software makes it possible for consumers to sign documents from anywhere at any time using their device or phone. Digital clients who are used to outcomes that require only a click, greatly value the speed and timeliness attained by completing transactions using an eSignature service.

Environmental benefits:

Financial institutions greatly minimize their use of paper by switching to digital signatures, which helps to save the environment.

Simple customer onboarding:

Because clients can submit all required papers online, electronic signatures simplify the onboarding process for banks. This eliminates the requirement for customers to visit the bank in person and turns it into a paperless transaction.

Improving efficiency:

Banks may dedicate more time to providing highly personalized customer care, fostering relationships of trust, and encouraging loyalty by reducing the amount of time spent on administrative duties.

Employees at banks will be happier in their jobs because they will have more time to focus on activities that advance their careers, like educating others and cultivating client loyalty, rather than wasting it on administrative duties.

Why is Signit the Best eSignature Solution for banking contracts?

Financial institutions can enhance the client experience by using the right technologies. From a commercial perspective, eSignatures save administrative expenses.

For banks, this could mean shortened loan application and account opening processing times, less administrative labor, more time to cultivate relationships with customers, and lower expenses for paper document imaging, scanning, and storage.

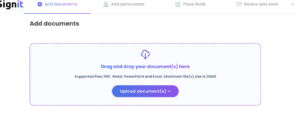

Finding a platform that does it all while adhering to the legal standards is difficult, but look no more. Signit is a digital signature solution that offers an all-in-one digital signature solution for financial firms. It helps in optimizing the signature workflows of the banks in the following ways:

Simplifying Loan Agreements and Applications

Traditionally, the loan application procedure requires a lot of paperwork, several in-person meetings, and a substantial amount of time. By enabling clients to complete and sign loan paperwork online at their convenience, Signit has made the process much easier and simplified.

Enabling Transactions and Account Management

Signit offers non-repudiation and online transaction authentication. Once the signature is obtained, the transaction cannot be contested.

Customers can electronically sign change requests (such as updating contact information or changing account features) online, ensuring that the changes are made by the actual account holder.

Improving Regulatory Reporting and Compliance Procedures

Signit offers a thorough audit trail, which is required for several transactions. Additionally, reports sent to regulatory agencies can be verified by digital signatures, meeting legal requirements.

Speeding Up and Securing the Process

At every point of the client journey, legal documents are essential to the financial and banking industries. Too much time is spent on paperwork processing and following up with clients to obtain consent from both commercial and retail banks.

With Signit’s digital certificate, you can include Signit into your workflow and significantly speed up and secure the signing process.

Saudi’s #1 Arabic E-Signature Solution

Empowering Saudi businesses with effortless digital signatures—secure, compliant, and designed for seamless use in both Arabic and English.

Start Free TrialEnsuring Secure Digital Signatures with Saudi SSO Platforms

Last but not least, Signit integrates user verification through advanced platforms like Absher and Nafath, Saudi government-approved Single Sign-On (SSO) solutions.

These integrations ensure that only verified individuals can sign agreements, providing a secure and trustworthy experience.

With these platforms, Signit allows users to confidently verify the identity of signatories, ensuring that agreements are signed by the intended individuals.

Additionally, Signit offers an audit trail feature, guaranteeing that no data is altered during the signing process or at any stage of the contract’s lifecycle. This ensures compliance, transparency, and trust for all parties involved.

Conclusion

Embrace the future of banking with Signit. Make the right decision by choosing Signit as your digital signature solution. Signit complies with the regional Saudi law and offers seamless integration with the existing system.

Read more about Understanding the Legality of a Electronic Signatures in KSA

Moreover, a team of professionals is available round the clock to address and resolve any inquiries regarding the solution.

Boost your banking performance by efficiently signing the documents using either the built-in templates or creating a customized one as per your requirements. Save money, time, and resources, and get a quote from Signit now!

Saudi’s #1 Arabic E-Signature Solution

Empowering Saudi businesses with effortless digital signatures—secure, compliant, and designed for seamless use in both Arabic and English.

Start Free TrialShare Article